The NFT market has exploded recently, with total NFT sales expected to exceed $2.5 billion in 2021 alone. This has raised the interest of artists, collectors, and investors. Even celebrities are trying to find ways to profit from NFTs. However, what precisely are NFTs, how do they work, and how can you make money with NFT?

You can sell your own NFT art or collectibles, invest in NFTs as an asset category, or create cash by engaging in NFT-based projects.

In this blog post, I’ll reconsider these choices in greater depth and provide some pointers and insights on starting. So, keep reading if you’re interested in learning more about how to make money with NFTs.

What is an NFT?

A non-fungible token (NFT) is a unique digital asset that is similar to a digital trading card. It’s one of a kind and cannot be replaced by anything. Non-fungible tokens (NFTs) are created using blockchain technology, which makes them unique and almost impossible to counterfeit. Therefore you’ll be able to buy, sell, or trade them confidently. NFTs are fun, collectible, and can have some real value.

NFT stands for Non-Fungible Token. NFTs are digital assets that can’t be changed with alternative holdings of the same type. Non-fungible tokens (NFTs) have unique values that depend on their specific characteristics and attributes. This means that NFTs differ from traditional cryptocurrencies, where all tokens are interchangeable and have the same value.

NFTs are also immutable, which means that once they’re created, they can not be modified or altered. This makes them a certain kind of asset ownership.

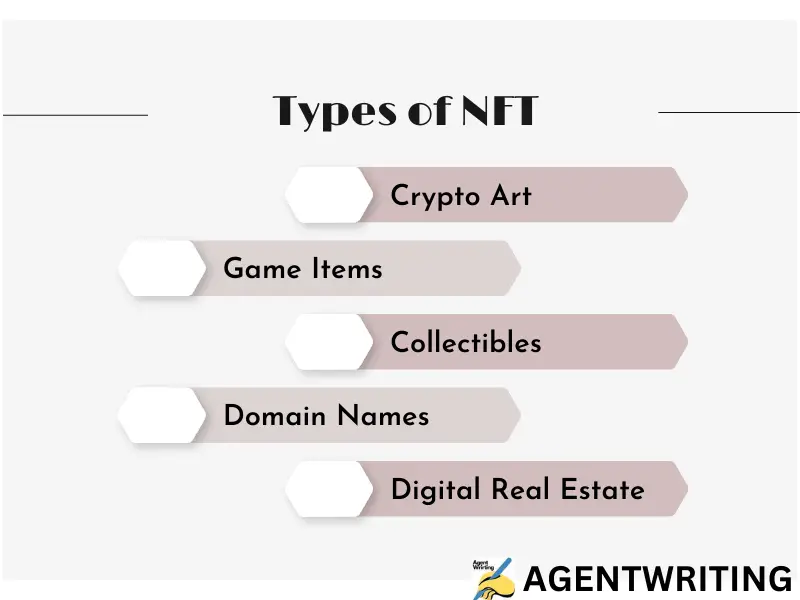

Types of NFT

Non-fungible tokens (NFTs) can be used to represent a variety of digital assets, including but not limited to artwork, video clips, game items, and real estate. Here are a few examples of the types of NFTs that are currently being used

Crypto Art

This type of NFT represents a design that can be bought and sold as a digital asset. It’s usually created as a digital file and stored on the blockchain.

Game Items

These are virtual assets such as weapons, armor, and different game items which will be bought and sold inside a game. They’re represented as an NFT on the blockchain and can be exchanged and traded.

Collectibles

There are digital assets, such as trading cards, figurines, and other collectibles, that can be bought and sold as non-fungible tokens (NFTs). They’re usually created and stored on the blockchain.

Domain Names

This represents the ownership of a website site or internet address. These types of digital real estate are typically defined as NFTs on the blockchain and can be bought and sold.

Digital real estate

There is a type of NFT that represents ownership of digital real estate, such as websites, applications, and other digital assets.

How are NFTs Stored?

Non-fungible tokens (NFTs) are digital assets that are stored on a blockchain. However, what precisely does that mean? And where are they stored?

A blockchain is a decentralized and secure digital ledger that is used to record transactions between parties. It’s called a “chain” because it consists of a series of blocks, each containing a record of multiple transactions. These blocks are connected in chronological order, forming a chain of blocks.

When it involves NFTs, each is stored as a unique record on the blockchain. This record includes information about the NFT, such as its distinctive uniqueness, metadata, and other relevant details. It also provides information about the transaction history of the NFT, who owns it, and when it was bought or sold.

The beauty of storing NFTs on a blockchain is that it ensures their credibility and origin. Because the blockchain is decentralized, no central authority controls it, which implies that the records kept on it are difficult to tamper with or falsify. This makes NFTs a secure and reliable way to store and transfer digital assets.

Non-fungible tokens (NFTs) are stored on specific blockchain platforms, such as Ethereum or Binance Smart Chain. These platforms offer the infrastructure and protocols required to create and keep NFTs and facilitate their buying, selling, and trading.

In summary, NFTs are stored on a blockchain as unique records that include information about the NFT and its transaction history. This ensures their credibility and provenance and permits for secure and reliable storage and transfer of digital assets.

How do NFTs Work?

Non-fungible tokens (NFTs) are created on a blockchain, which is a distributed ledger technology. This implies that the tokens are stored on a public ledger and are available to anyone with access to the blockchain.

When someone buys an NFT, the transaction is recorded on the blockchain. This makes it simple to trace the ownership of the token and ensures that it’s securely stored on the blockchain. The blockchain additionally ensures that the token is exclusive and can’t be counterfeited.

What are NFTs used for?

NFTs are used for a variety of functions. They can be accustomed to representing artwork, music, gaming items, and more. They can even be accustomed to representing digital assets, like cryptocurrencies.

NFTs can also be used to represent physical assets, such as real estate. This makes tracking asset ownership easier and ensures it is securely stored on the blockchain.

How NFTs are Bought and Sold

NFTs are often bought and sold like other assets, similar to traditional stocks and bonds. They can even be purchased and traded directly between buyers and sellers without going through an exchange.

When buying or selling an NFT, it’s necessary to ensure the transaction is secure. This means ensuring that the token is stored on the blockchain and that the transaction is recorded.

Benefits of Using NFTs

NFTs, or non-fungible tokens, have gained a lot of attention in recent years for their ability to provide secure and verifiable ownership of digital assets. But what are the other benefits of using NFTs? Here are a few key points to consider:

Increased Ownership and Control

With NFTs, you have full ownership and control over your digital assets. This is particularly useful for artists and creators who want to protect their intellectual property and have more control over how their work is used.

Greater Security and Authenticity

NFTs provide a way to verify the authenticity and ownership of digital assets, which helps to reduce instances of counterfeiting and intellectual property theft. This provides users with greater protection and assurance of their property rights.

Enhanced Value and Scarcity

Because NFTs are unique and non-replicable, they often have greater value and scarcity compared to traditional digital assets. This can make them more attractive to collectors and investors and can increase their market value over time.

Improved Tracking and Transparency

Non-fungible tokens (NFTs) are stored on a blockchain, which is a decentralized, transparent, and immutable ledger that can record ownership and transactions. This makes it easier to track and verify the provenance of digital assets and can increase their perceived value.

New Opportunities for Creators

NFTs can open up new opportunities for creators by providing a new way to monetize their work. By minting their own NFTs, creators can sell digital copies of their art, music, or other creative work directly to fans and collectors. This can provide a new source of revenue for creators and help them reach a wider audience.

Increased Liquidity

NFTs can increase the liquidity of digital assets by making it easier to buy and sell them. This can be particularly useful in industries like art and collectibles, where it can be difficult to find buyers for physical items. With NFTs, buyers and sellers can easily connect and transact online, which can make it easier to turn digital assets into cash.

Overall, the benefits of using NFTs are numerous and include increased ownership and control, greater security and authenticity, enhanced value and scarcity, and improved tracking and transparency. As technology continues to evolve and become more widely adopted, it’s likely that we will see even more benefits emerge.

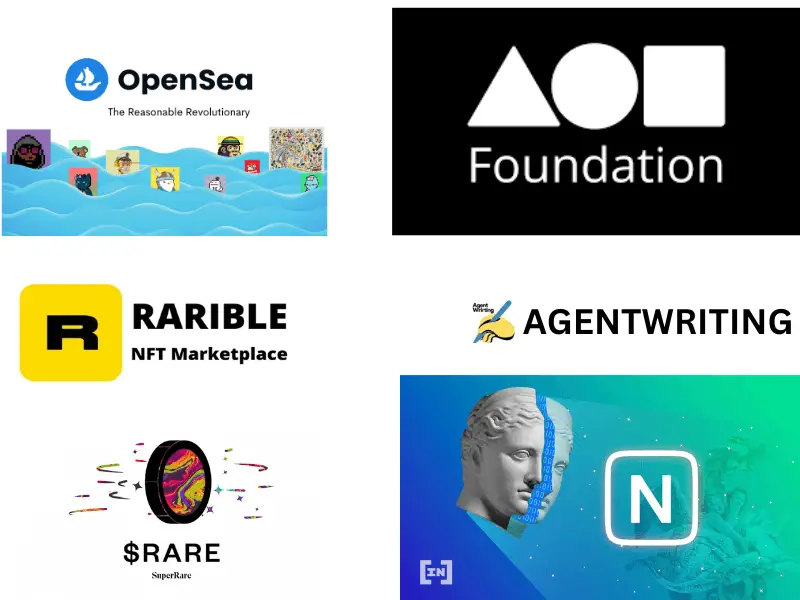

Popular NFT Platforms

There are many popular platforms that are frequently used for buying, selling, and trading NFTs. Some of the most well-known platforms include:

OpenSea

OpenSea is an NFT marketplace founded in 2017 by Devin Finzer and Alex Atallah. It is a localized platform that enables users to buy and sell a large variety of NFTs, art, collectibles, and even virtual real estate. OpenSea is known for its easy interface and various NFTs, creating a popular selection for both consumers and sellers.

Foundation

Foundation is an NFT platform founded in 2018 by Matthew Roszak to democratize access to NFTs. It is a decentralized platform that enables users to buy and sell NFTs and create and mint their own. Foundation is known for its total concentration on the art world and has partnerships with major galleries and institutions.

Rarible

Rarible is an NFT marketplace founded in 2020 by Aleksandra Skrzypczak and Ivan On tech. It is a decentralized platform that permits users to buy and sell NFTs and create and mint their own. Rarible is known for its user-friendly interface and easy-to-use minting method, making it a popular alternative for NFT creators.

SuperRare

SuperRare is an NFT platform founded in 2017 by John Orion Young and Dadi Sturluson. It is a decentralized platform that focuses on digital art, allowing users to buy and sell NFTs and create and mint their own. SuperRare is known for its sturdy emphasis on quality and only accepts a small percentage of submissions from artists.

Nifty Gateway

Nifty Gateway is an NFT platform founded in 2018 by Trevor Jones and Duncan Cock Foster. It’s a centralized platform that allows users to buy and sell NFTs and produce and mint their own. Nifty Gateway is known for its partnerships with major brands and celebrities and focuses on high-end collectibles.

Each platform has its distinctive features and focus, creating them all worth considering for NFT trading. It is often a simple plan to do your analysis and compare different platforms to find the one that most closely fits your wants.

Who Can Create an NFT?

Anyone with an idea and access to the technology, including artists, musicians, entrepreneurs, and other creatives, can produce and own an NFT. All you need is a brilliant idea turned into a digital asset and the technical skills to make it.

What Does One Need to Produce an NFT?

To make an NFT, you’ll need access to a digital asset, an image, a 3D model, a video, a piece of music, or any other digital file. You will additionally need an Ethereum wallet, a free digital wallet linked to the Ethereum blockchain, which will permit you to store and manage your transactions.

Finally, you’ll need the technical know-how to develop your digital asset and build a smart contract on the blockchain—this includes coding your asset on the Ethereum blockchain, which may take some technical power.

Step-by-Step NFT Creating Process

Create Your Digital Asset

This is the first step towards creating an NFT – you’ll need to create the asset itself. NFTs can be used to represent a wide range of digital items, including but not limited to pictures, 3D models, videos, and music tracks.

Connect with a Blockchain Platform

Once you’ve created your asset, it’s time to link it with a blockchain platform. Like Ethereum, where you can store, manage, and monitor your assets and transactions.

Develop a Smart Contract

Next, you need to develop a smart contract on the blockchain. This is where the asset will be stored and tracked.

Set a Price

Once your NFT is live on the blockchain platform, you can set a price at which people can buy the digital asset.

Publish Your NFT

Finally, it’s time to publish your NFT and make it available to anyone who wants to purchase it.

What is Minting? And What is the Purpose of Minting?

Minting is making a non-fungible token (NFT) or digital asset and encrypting it onto the blockchain.

It is why NFTs are so rare and need an exact amount of effort to create or purchase items. It’s the defining characteristic of tokens that makes them non-interchangeable and authentic.

Mint your NFT

Once you’ve created your NFT, the next step is to mint it. This generally involves paying a fee to the blockchain to have your NFT added to the blockchain and verified as unique. The fee for selling NFTs may vary based on the blockchain platform being used and the size of the NFT.

How to Sell an NFT?

If you’re used to the typical sales process, selling an NFT will be quite a different experience! Non-fungible tokens (NFTs) are gaining popularity in the entertainment, gaming, and cryptocurrency industries and have the potential to bring significant profits. In order to tap into this potential, it is necessary to understand the process of selling NFTs.

Selling NFTs is a different method compared to typical sales. You must possess an NFT wallet and enlist your tokens on an NFT marketplace like OpenSea, Rarible, or Mintable. These marketplaces have different features and services to decide on from.

What Fees are Associated with Selling NFT?

If you are considering selling NFTs, what fees are associated with the process? After all, you want to ensure you get the best deal possible and maximize your profits.

It is important to be aware that you may encounter various fees when selling NFTs. These include:

Transaction Fees

These are fees that are charged by the blockchain network for processing and validating transactions. Transaction fees are generally paid in the form of cryptocurrencies, such as Ether or BNB.

Marketplace Fees

Many NFT marketplaces charge a percentage of the sale price as a fee for hosting and facilitating the sale. This can range from a few percent to as much as 20%.

Escrow Fees

If you use an escrow service to hold the funds from your NFT sale until the transaction is complete, you may be charged a fee. Escrow fees can vary depending on the provider and the terms of the agreement.

Taxes

Depending on your location and tax laws, you may be required to pay taxes on any profits you make from selling NFTs.

It’s essential to keep these fees in mind when setting the price for your NFTs, as they will eat into your profits if you are not careful. Make sure to analyze and compare different choices to seek the only cost-effective answer. And it is usually a good idea to consult a tax professional if you have questions about your tax obligations.

Why Should You Sell Your NFT?

So, why do you have to plunge and sell your NFT? Because it comes down to potential profits. From collectivism to artwork, there’s no limit to what an NFT can represent, and that’s why many digital assets are worth so much money! You’ll create some serious cash by trading NFTs since they’re among the most popular digital assets.

How to Buy an NFT: Buy Now, Auctions, Offers

When it comes to the way to buy an NFT, most marketplaces offer many completely different buying choices. You can purchase directly with “buy now” pricing. Otherwise, you can enter an auction to get a competitive price. You can also propose a creator’s asset if it needs to be listed with a buy now or auction.

Step-by-Step NFT Buying Method

The NFT buying method is split into several steps when you’re ready to buy.

First, you’ll need to find the specific NFT you want to buy and add it to your cart.

Once you’ve selected your NFT, you may connect your wallet by entering your address.

After that, you’ll need to confirm the deal and ensure your NFT has been purchased.

Once the NFT is in your wallet, you’re all set.

What Is the Proof of NFT Ownership?

Once a person has purchased an NFT, they become the legal owner of the digital quality. The proof of ownership is provided by the public ledger created on the blockchain that stores and tracks each NFT. This ledger is immutable and verifiable and provides evidence that the transaction has taken place in which the ownership of the NFT has changed hands.

Mining NFTs

Mining NFTs involves creating and storing digital assets on a blockchain to provide secure ownership. Non-fungible tokens (NFTs) are unique digital assets that are represented by cryptographic tokens. They can be used to represent a variety of digital items, such as artwork or game items.

The ERC-721 standard could be a well-liked NFT protocol used on the Ethereum blockchain. Mining NFTs require specialized skills and an understanding of the technology and trends in the field.

To mine NFTs, a person needs to have an Ethereum wallet and be familiar with the principles and protocols of the precise NFT platform they are using. They must also purchase blockchains, computing power, and Ethereum tokens. After obtaining these resources, the miner can create and store a digital asset on a blockchain.

The benefits of mining NFTs embrace secure and verifiable ownership of digital assets, protection against counterfeiting and theft, and the ability to trace and transfer digital property.

Top 10 Popular and Wired NFT Examples

CryptoPunks

Developed by Larva labs, this collectible is based on Ethereum and is one of earliest NFTs in existence. It was released in 2017, and since then has sold examples for over $7million.

Beeple’s Everydays

The Creation: This magnificent piece of digital art was created by Beeple, a well-known digital artist and part of the Ethereum ecosystem. It was sold for $69million through Christie’s, setting a record as the most expensive NFT item of all time.

CryptoKitties

Developed by AxiomZen and based on Ethereum, CryptoKitties are amongst the most popular NFTs. They come in different shapes, colors and characteristics, and one of these sold for a whopping $170k.

NBA Top Shot

This blockchain based platform is based on Ethereum and allows users to assemble digital packs and trade different cards. It is linked to the official NBA brand and one of its rarest series was sold for over $200,000.

First Edition Crypto Voxels

This platform is based on Ethereum and is the first generation of NFTs owned by early adopters. It lets users own virtual real estate on virtual landscapes, and one of the first pieces sold for $80,000.

Dapper Labs’ Cheeze Wizards

Developed by Dapper Labs, this blockchain based game was released in 2019. It rewarded players with asset backed NFTs, like the Golden Cheeze Wizard created by 3LAU, which was sold for $71,500.

ENS Nifty Gateways

This platform is linked to the Ethereum Name Service, and allows users to purchase domains beginning with the characters 0x.. One of its records was sold for $750,000.

Async Artwork

This was also developed by Larva Labs and is part of the Ethereum ecosystem. It allows users to purchase digital artwork as one piece. Its rarest piece was sold for $611,000.

NyanCat

Developed by @PR0FIT_ken, this project is based on Ethereum, and it can be purchased as a collectible item. The most expensive piece of this artwork was sold for a whopping $590,000.

Gods Unchained

The game was developed by Immutable and based on Ethereum. It is currently the largest blockchain gaming project and its rarest item was sold for over $400,000.

The Wired NFT example is a rare edition digital art piece depicting Woody Harrelson as Mickey Goldman in the 2000 classic movie, The Royal Tenenbaums. The NFT was created by the artist Jonny Vingo and was issued on the Ethereum blockchain in June 2021. It was sold via the OpenSea marketplace for 0.104 ETH, which is equivalent to approximately $1,600 USD. The NFT has a unique 512 x 512 pixel design, created in ether pixel code, and a lifespan of one year. It is distributed in the form of a non-expiring, tamper-proof digital asset.

Potential Risks, Scams and Challenges Involved with Making Money with NFTs

Regulatory Risk

The regulatory landscape surrounding non-fungible tokens (NFTs) is still in its early stages, which means there’s a risk that governments could implement regulations that negatively impact the NFT market.

Technical Challenges

The underlying technology of NFTs, such as blockchain, is often complicated and may present challenges for those unfamiliar. In addition, there are also technical problems with the platforms used to buy and sell NFTs, which might cause delays or other issues for users.

Pricing Volatility

The price of NFTs can be highly volatile, suggesting that the worth of an NFT will fluctuate significantly over a short time. This could make it difficult for buyers and sellers to assess an NFT’s value accurately.

Lack of Liquidity

The NFT market is still comparatively small, so there may be a need for more liquidity in specific market segments. This will make it troublesome for buyers and sellers to find each other and may additionally lead to broad price spreads between different NFTs.

Misleading Artwork or Creation

Some NFTs could also be marketed as unique or one-of-a-kind. However, indeed might be more common and unusual than they claimed to be. This can be misleading for buyers who may be paying a premium for something that could be more valuable than they thought.

Fake Websites

There have been instances of fake websites being set up to scam individuals out of their cash by marketing fake or non-existent NFTs. It’s essential to analyze in depth and only purchase NFTs from prestigious sources.

Fake Auctions

There have also been instances of fake auctions being set up to sell non-existent NFTs or NFTs that do not belong to the seller. It is important to be cautious and verify the authenticity of any NFTs being sold at auction.

Phishing Scams

Phishing scams, where hackers send fake emails or messages purporting to be from legitimate companies or individuals in order to obtain sensitive information or money, can also be a risk when it comes to NFTs. It is important to be vigilant and not click on any links or provide personal information to unfamiliar sources.

Fake Accounts

There have been instances of fake accounts being set up on NFT marketplaces, often with the intent of scamming people out of their money. It is important to verify the authenticity of any account before making a purchase or sale.

Pump-and-Dump Schemes

Pump-and-dump schemes, where a group of individuals artificially inflate the price of an asset and then sell it off, can also occur in the NFT market. It is important to be cautious and do thorough research before making any investment decisions.

How to Secure the NFT Trading and Holding

If you’re involved in the NFT space, whether as a trader, collector, or creator, you probably want to know how to secure your NFTs and protect them from potential threats. After all, NFTs can be valuable assets, and you don’t want to risk losing them due to security breaches or other issues.

So, what can you do to ensure the safety of your NFT trading and holding? Here are a few tips:

Use a Secure Wallet

In order to ensure the safety of your NFTs, it is necessary to store them in a secure wallet. This can be a hardware wallet, such as a Ledger or Trezor, or a software wallet, such as MetaMask or MyEtherWallet. Whichever type of wallet you choose, be sure to use a strong, unique password and keep it in a safe place.

Enable 2FA

Two-factor authentication (2FA) is a security feature that requires you to provide an additional code in addition to your password when logging into your accounts. This added step can help to prevent unauthorized access to your accounts by hackers. Many NFT marketplaces and wallets offer 2FA as an option, so be sure to enable it if it’s available.

Use a Secure Connection

When trading or interacting with NFTs online, be sure to use a secure and protected website connection, such as VPN, and the website must have HTTPS or SSL. This helps to protect your data from being intercepted by third parties.

Keep Your Software up to date

It is important to regularly update your software and devices with the latest security patches and updates to ensure optimal security. This can help to prevent vulnerabilities from being exploited by hackers.

Set a Strong Password

A strong password is an essential element of good security practices. It helps to protect your accounts and sensitive information from unauthorized access and online threats. Here are a few tips for setting up a strong password:

- Use a mix of letters, numbers, and special characters: A strong password should include a combination of upper and lower case letters, numbers, and special characters. This makes it more difficult for hackers to guess or brute force their way into your account.

- Make it long: The longer the password, the stronger it is. Aim for at least 12 characters, and the longer the better.

- Avoid using personal information: It is advisable to not include personal information, such as your name or birth date, in your password. Hackers may be able to find this information through social media or other sources, which could make it easier for them to guess your password.

- Use a password manager: A password manager is a useful tool that can assist you in generating and storing complex, unique passwords for all of your accounts. This can save you the hassle of trying to remember multiple passwords and also provide an extra level of security for your accounts.

- Don’t reuse passwords: To ensure the security of all your accounts, it is important to use a unique password for each one. Reusing passwords can be risky because if a hacker is able to gain access to one account, they may be able to use the same password to log into your other accounts as well.

By following these simple steps, you can significantly improve the security of your NFT trading and holding. It’s always a good idea to be vigilant and stay up to date with the latest security best practices to protect your valuable assets.

Legal Issues of NFTs

Collection and Taxation

One of the most common legal issues related to NFTs involves the collection and taxation of gains. Because most NFTs have no real-world value, it can be difficult for governing bodies to properly track and tax these types of digital assets.

Regulatory Uncertainty

There is a lot of uncertainty surrounding the legal status of NFTs and how they should be regulated. This lack of clarity has complicated the landscape and has made it difficult for companies and developers to effectively comply with their regulatory obligations.

Intellectual Property Rights

NFTs often contain copyrighted materials, making the legal issue of intellectual property rights even more complicated. It is important to ensure that NFT creators and platforms properly protect the rights of artists, creators, and any other party that has a stake in the intellectual property.

Money Laundering

Since NFTs are a digital asset, they can be easily used as a vehicle for money laundering or other nefarious activities. As such, governments should examine NFTs closely to ensure that they are not being used to facilitate criminal activity.

Data Privacy

NFTs can collect a wealth of data from users, and the legal issue of data privacy is of utmost importance. Companies must be sure to adhere to data privacy laws and provide users with proper warnings about the risks of sharing their data with third parties.

The Impact of NFT Technology

Non-fungible tokens (NFTs) are a type of digital asset that can be used to verify the authenticity and ownership of digital items. They offer a unique way to control and manage distinctive digital assets and may potentially revolutionize the way we perceive the value of digital items. NFTs also open up new opportunities for artists and creators to monetize their work. This has the potential to reduce counterfeiting and property felonies and alter the way we predict ownership within the digital world.

On a broader level, NFT technology has the potential to democratize the art world by allowing anyone with an online connection to participate in the market and potentially make a profit from their art. The total impact of NFT technology remains largely unknown.

However, it’s potential to significantly change the way we predict ownership and authenticity within the digital world.

CONCLUSION

In conclusion, the NFT market has opened up a world of possibilities for making money with digital assets. Whether you’re an artist or a collector, an investor or a freelancer, there are various ways you can get involved in the NFT space and potentially turn a profit.

Selling your own NFT art or collectibles is a great way to make money with NFTs if you have a unique and desirable product. Investing in NFTs can also be a lucrative option, although it’s important to do your due diligence and research the projects and artists you’re considering investing in. And if you have the skills and expertise, you can also earn money through NFT-based projects by participating in airdrops, freelancing, or creating your own NFT-based games or apps.

As the NFT market continues to grow and evolve, it’s worth keeping an eye on new opportunities and trends that might emerge. And if you’re interested in making money with NFTs, don’t be afraid to experiment and try out different strategies to see what works best for you. Good luck!